African Space Economy: Industry Projected to Grow Exponentially by 2026

By Richard Adorsu-

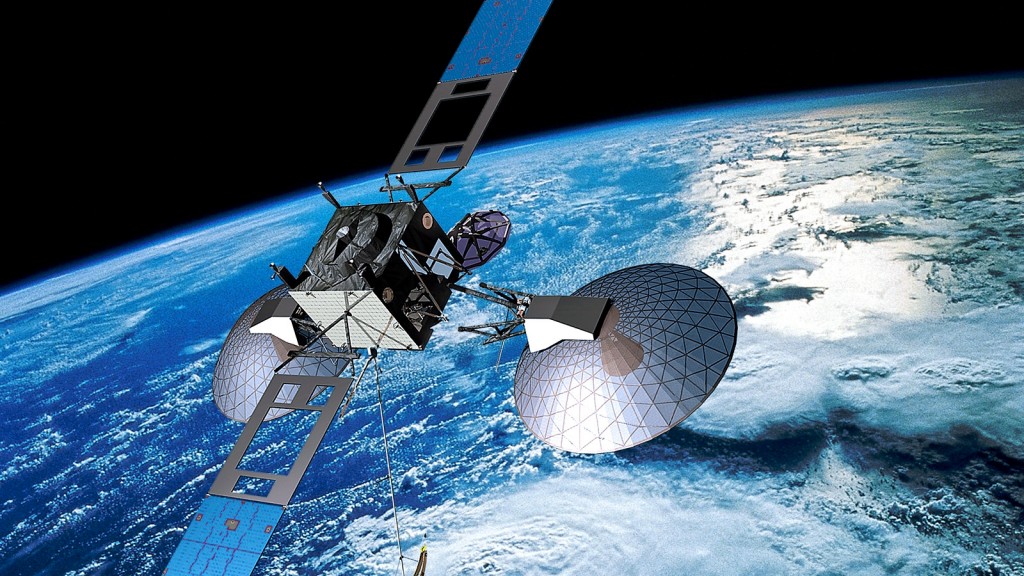

Photo Credit: yesofcorsa.com

NEW AFRICA BUSINESS NEWS (NABN) Accra Ghana- The African space economy keeps growing at a rate beyond Africa’s GDP growth rates and becoming a strategic tool for boosting the national economy and contributing toward achieving the Sustainable Development Goals (SDGs) in Africa.

African space industry is valued at USD 19.49 billion in 2021 and is projected to grow by 16.16% to USD 22.64 billion by 2026. In addition, the African space economy employs a workforce of over 19,000 across different sectors, with the government which is the highest employer in the industry employing over 11,000 staff.

African nations allocated USD 534.9 million to national space programmes in 2022. This amount marked a 2.24% increase from the revised USD 523.3 million in 2021. National budgets consistently contribute to the industry valuation annually, and governments’ contributions increased by 80.83% in 2021 from the revised USD 289.33 million in 2019 to USD 523.2 million.

Many African countries are also improving on their space application goals as different national priorities span space democratisation, propulsion & launch technology development, human capacity development, and local and international space partnerships, amongst others.

The satellite communication market, which includes Fixed Satellite Services (FSS), Mobile Satellite Services (MSS), and Satellite TV services, accounts for a major share of the African space and satellite industry valuation in 2021. A considerable share of this revenue comes from the African satellite TV market, with major satellite tv operators like DSTV, Canal+ Afrique, and StarTimes dominating the market regarding revenue generation, subscriber base, and

countries served.

The downward trend within the satellite component manufacturing segment is attributed to the reduction in revenues of some companies, several companies getting shut down, while some are still working on marketing their first products and, as such, have not been generating revenues.

In general, the satellite manufacturing segment (which comprises satellite systems and components, satellite manufacturing and launch and propulsion systems).

With more companies growing their market base and several others generating income from the sale of the new and improved production line], satellite manufacturing is expected to grow in the coming years.

The downstream segment is playing an essential role in driving the market. The EO data reselling, EO and geospatial training/certification courses, scalable geospatial and remote sensing solutions, and precision agriculture solutions and services are the top demand within the EO segment that present investment opportunities to the foreign commercial players.

The ground segment market has massive potential in the African space industry. This industry segment estimates the value of developed satellite ground stations and the astronomy infrastructures installed, including telescopes and other astronomy equipment, in 2021. Many African countries want to develop and launch satellites in the next five years.

Since nearly all missions, including commercial, military or scientific payloads, use space ground systems for launch and on-orbit operations, the ground segment is expected to boost the African space market.

There has been a paradigm shift from large to small satellites, primarily due to the high cost of manufacturing large satellites and the long development time. The possibilities for small satellites are endless, with several applications being explored to have a tangible impact and directly translate to socioeconomic and environmental development in Africa. These innovative small satellite applications include the Internet of Things (IoT), weather forecasting and early warning systems, crop and livestock monitoring for agricultural purposes, etc.

In 2022, Space in Africa estimates that 272 NewSpace companies are charting the course of space democratisation on the continent. These companies, domiciled across 31 African states, are innovating novel methods of leveraging space technologies and its derived data] to develop cutting-edge technologies and solutions across several fields, including manufacturing, medicine, transportation and logistics, and much more.

These companies provide goods or services primarily to other private sector entities (B2B) and/or consumers (B2C), and sometimes, the government. Furthermore, in most African regions, private companies leverage space systems and infrastructures built by the government and/or foreign organisations to provide niched solutions/services, including decision-ready datasets, satellite and component manufacturing, and satellite communication services (e.g. internet services, DTH Tv, satellite radio, among other).

Human capacity development is the bedrock of Africa’s space ecosystem development and has prompted considerable investment from several African public and private actors. The long-term goal of any capacity development programme is to bring about a more robust national space ecosystem in African countries.

However, the current landscape of the African space industry shows a lack of skilled human resources across all space industry sectors, making it difficult to take advantage of several technological advancements. Also, the lack of infrastructure at different levels of the education sector to support human resource development has slowed the progress across the continent.

However, the continent is beginning to witness slow but consistent growth, especially with improved investment from all space actors to enhance the education and training of experts, creating the required testing and building infrastructure, enabling the environment to foster international cooperation and the necessary legal and regulatory frameworks. To this end, several capacity development initiatives have been organised to proffer solutions to the industry’s human capital gap and establish a sustainable talent pipeline to meet future skills needs.

The 2022 edition of the Africa Space Industry Annual Report is published by Space in Africa, the authority on news, data and market analysis for the African space and satellite industry. It presents data and analyses on projects, deals, partnerships, and investments across the continent.

It also analyses the growing demand for space technologies and data on the continents, the business opportunities it offers and the necessary regulatory environment in the various countries.

For New Africa Business News Richard Adorsu Reports, Africa Correspondent