Africa’s Online Retail realm, herded by the Novel Coronavirus disease (COVID-19) impact… hurled a considerable growth in attention towards data centers across the Landmass

By Abdul Rahman Bangura-

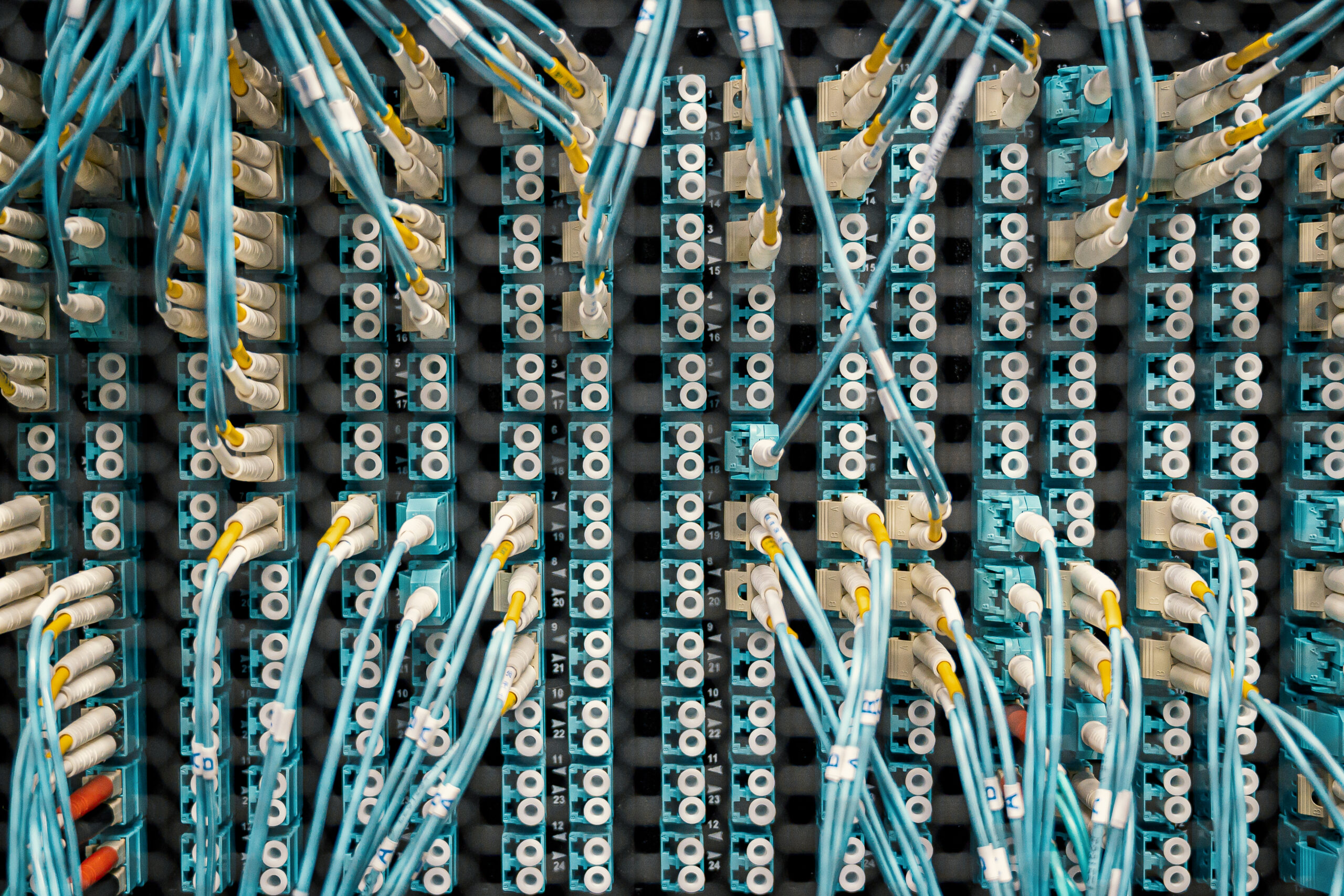

Photo Credit: Pixabay

NEW AFRICA BUSINESS NEWS (NABN) Freetown, Sierra Leone- A previously published report by Knight Frank emphasizes that data centers illustrate a better prudent and productive IT solution described in relation to in-house servers, heightening their request.

These centers similarly transmit cloud services, authorizing organizations to concentrate on their core undertakings. Investors have taken heed of the rising need for more data centers in Africa.

An excerpt from the report highlights this trend: “Investment in the market is projected to have a Compound Annual Growth Rate (CAGR)

of approximately 15% from 2020 to 2026. In 2020, the data center market size in terms of investment was valued at $2 billion, and it is expected to reach $5 billion by 2026.” An extract from the report features.

Various substantial pacts have carried…across the landmass, comprising Digital Realty’s acquisition of Terraco for $3.5 billion. This obtainment pursued Digital Realty’s investment of iColo, a leading Kenyan-based platform with facilities in Nairobi and Mombasa, a

central subsea cable access point for Africa. Additionally, Equinix joined the African market by amassing MainOne data centers, a firm with an existence in Ghana, Côte d’Ivoire, and Nigeria, for $320 million. Further investments are also spewing in, with NTT and Vantage Data Centers committing over $500 million to new data centers in Johannesburg and the enclosing areas.

Pan-African players like Africa Data Centers, Raxio, and PAIX, as well as global giants like China Mobile and Alibaba, are already operational or entering new markets, including the Democratic Republic of Congo, Congo, Ghana, and Côte d’Ivoire.

While South Africa, particularly Johannesburg, has been the dominant player in the African data center landscape due to its strategic location, abundant subsea cable landing stations, political stability, mature enterprise markets, and corporate presence, other hubs are emerging in Nigeria, Egypt, Kenya, and Morocco.

The African data center landscape appears promising in the coming years, with expectations of increased merger and acquisition (M&A) activity, primarily led by US data center operators.

Stakeholders are actively seeking viable development sites with power, fibre, and permitting potential across the landmass, foreseeing crucial advancement in the sector in 2023-2024.

For New Africa Business News (NABN) Abdul Rahman Bangura Reports, Africa Correspondent