Africa Continues to Lead in Mobile Money Adoption, With Over $403 Billion in Transactions, Report

By Richard Adorsu-

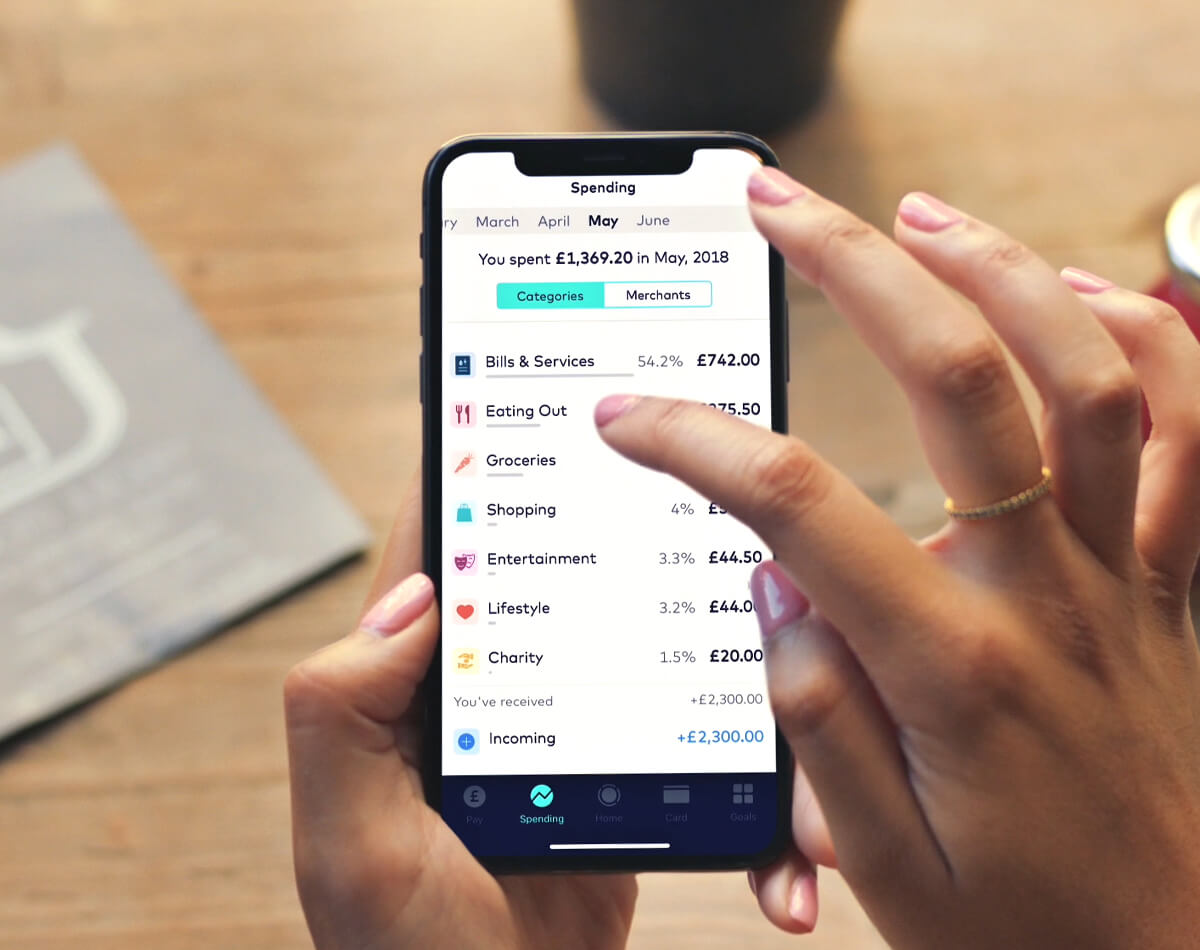

Photo Credit: Starlingbank

NEW AFRICA BUSINESS NEWS (NABN) Accra GHANA- Mobile money has evolved from a narrow product service in a few markets to a global financial service. According to MoneyTransfers.com, registered mobile money accounts stood at 1.35B by the end of 2021. This is an 18% growth from 2020.

In 2021, mobile money adoption and usage increased over the previous year. Last year, there were more than 1.5 million person-to-person (P2P) hourly transactions, a 22-fold increase since 2012.

“The mobile phone is arguably the most disruptive gadget we’ve ever had,” says Jonathan Merry, CEO of Money Transfers. He adds, “Apart from revolutionizing the way we interact, it is changing how we access and manage our finances, among others. The ubiquity of mobile money services is helping attain financial inclusion, streamlining payments and providing users greater freedoms over their funds. Is it any wonder that their adoption is booming?”

The COVID-19 pandemic hastened this transition. Most people now use virtual, no-contact methods to buy items, pay bills, receive, and send money. This continued growth helped push the value of transactions to the trillion-dollar mark in 2021. A milestone reached faster than anyone in the industry could have predicted.

The future of mobile money. Many reasons make mobile banking grow faster than anticipated. The world is becoming a digital society, influencing how people live. Mobile money has come in handy to fill the gap created by traditional money transfer mediums. Mobile money is in high demand. Its convenience is one aspect that pushes its growth daily. Imagine receiving cash anywhere around the globe at the convenience of your couch. What’s more, you can pay for your expenses remotely.

It is not surprising that several banks are adopting mobile banking services. Financial institutions are entering partnerships with FinTech’s that are offering mobile money. The move is due to the market shift. Banks are noticing that clients no longer subscribe to brand loyalty. Instead, they prefer speed, convenience, accuracy, transparency, and other technological growth. Besides, most people prefer mobile banking due to its security features.

From the survey, merchant payments were among the notable drivers of growth in mobile money in 2021.